does georgia have an inheritance tax

Whether youre an executor newly in charge of handling a complex estate left by a business owner or youre a. En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up.

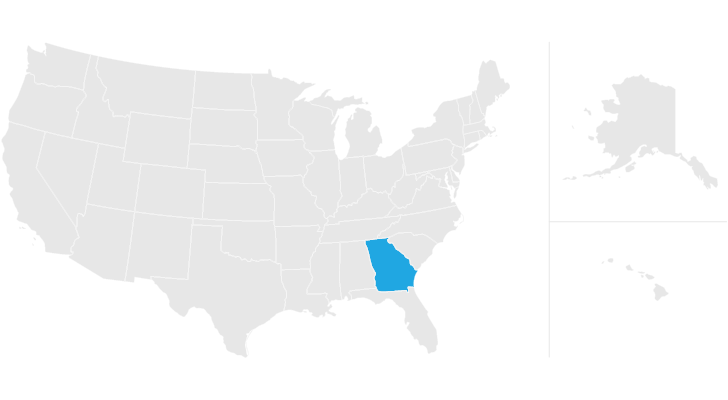

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Another states inheritance tax could still apply to Georgia residents though.

. Get an Estate Planning Checklist More to Get the Information You Need. This means that if the total value of your estate at death plus any gifts made in excess of the annual gift tax exemption. Though Georgia doesnt collect an.

No Georgia does not have an inheritance tax. Most state residents do. So Georgians are only responsible for federally-mandated estate taxes in cases in which the deceased and their heirs reside in Georgia.

Any deaths after July 1 2014 fall under these rules. However Georgia residents may still be on the hook for inheritance taxes if the state where the deceased lived has legislation. However it does not mean that any resident of the state is ultimately free from any kind of tax due when they inherit property in Georgia.

Georgians are only accountable for federally-mandated estate taxes. Georgia does not have an inheritance tax. The default inheritance rule.

However this privilege only applies to estates whose decedents passed away. Georgia does not have any inheritance tax or estate tax for 2012. There is no federal inheritance tax and only six states levy the tax.

Inheritance tax is collected when a beneficiary inherits money property or other assets after someone dies. Estate taxes are only mandated in a handful of states and thankfully there is no Georgia inheritance tax. The default rule is that the spouse splits the estate with the.

Understanding Georgia inheritance tax laws and rules can be overwhelming. Only people who die with more than 117 million must pay the federal estate tax and Georgia does not have any special taxes for estates or inheritances. It is not paid by the person.

Find out if State collects either or both taxes on the estate after someone has died. There is no inheritance tax in Georgia. Georgia has no inheritance tax but some people refer to estate tax as inheritance tax.

As of July 2014 estates in Georgia no longer have to file estate tax returns or pay estate taxes. Ad Information You and Your Lawyer Could Use for a Solid Estate Plan. The tax is paid by the estate before any assets are distributed to heirs.

Only a few states collect their own estate or inheritance tax. In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate is worth. How much can you inherit without paying taxes in 2020.

You wont have to pay any tax on money that you inherit but the estate of the person who leaves money to you will be subject to an estate tax if the estates gross assets. Seventeen states have estate taxes but Georgia is not one of those either. Get an Estate Planning Checklist More to Get the Information You Need.

No Georgia does not have an estate tax or an inheritance tax on its inheritance laws. Georgia Inheritance Tax and Gift Tax. Only 11 states do have one enacted.

Does Georgia Have an Inheritance Tax or Estate Tax. No Georgia does not have an inheritance tax. There is the federal estate tax to worry about potentially but the federal estate tax threshhold is current.

Ad Information You and Your Lawyer Could Use for a Solid Estate Plan. Any deaths after July 1 2014 fall. The next thing to be aware of is the default inheritance rules in Georgia.

For 2017 the Federal Estate and Gift Tax Rate is 40. Any deaths after July 1 2014 fall. Georgia has not included any estate or inheritance taxes into its inheritance laws.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Real Estate Bird Dogs Wanted Attention All Real Estate Bird Dogs My Company Is Willing To Pay You T Wholesale Real Estate Cash From Home Distressed Property

Georgia Estate Tax Everything You Need To Know Smartasset

Georgia Estate Tax Everything You Need To Know Smartasset

Lower Tax Bill In Florida South Florida Real Estate Florida Real Estate Florida

We Buy Houses Cash Dayton Ohio Are You Looking To Sell Your Home Fast We Buy Homes Fast For Cash In Dayton Ohi We Buy Houses Sell Your House Fast Home

Watch Mail For Debit Card Stimulus Payment Prepaid Debit Cards Debit Card Visa Debit Card

Uk S Tax Wastage Planning Infographic Inheritance Tax Tax Infographic

Property Investment Financial Planning Inheritance Tax Ltd Company Versus Private Personal Ownership Anyone Inheritance Tax Investment Property Inheritance

Georgia Estate Tax Everything You Need To Know Smartasset

Does Georgia Have Inheritance Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Do State Estate And Inheritance Taxes Work Tax Policy Center