are hearing aids tax deductible 2021

The short and sweet answer is yes. Only medically required equipment is eligible to be deducted.

Income tax rebate for hearing aids.

. You can only deduct medical. You can also deduct visits to. Many of your medical expenses are considered eligible deductions by the federal government.

Premiums for hearing aid insurance and other medical insurance. Hearing aids hearing aid batteries and accessories for hearing. On her 2021 tax return Amy is allowed a premium tax credit of.

In order for hearing aids or other medical expenses to qualify as tax-deductible the total cost of all medical expenses will need to be greater than 75. Multiply the yearly depreciation by the age of the aids. The good news is that if you have an income and pay income tax you can claim a tax offset for any out-of-pocket costs on your hearing aids.

As one would expect hearing aids are tax-deductible within. The IRS agrees hearing aid costs are partly deductible from 2021 tax returns as well as 2020 and 2019 ones. Since hearing loss is.

The IRS allows you to deduct as qualified medical expenses the costs of preventive medical care treatments surgeries and dental and vision care. Hearing aids like most medical expenses are sometimes tax-deductible reducing the overall outlay. Those with hearing issues can deduct the costs of exams and hearing aids including batteries.

Hearing aids can often qualify as a tax deduction though there are still several stipulations that the 10 million Americans with hearing aids will want to pay attention to. Conclusion Are Hearing Aids Tax Deductible. Expenses related to hearing aids are tax.

Hearing Aids are Tax Deductible Being able to include your. If you need a unit for each ear youre looking at. By deducting the cost of hearing aids from their taxable income wearers could reduce the cost of their hearing aids by up to 35.

Hearing aids are most certainly a medical expense that is tax-deductible in Canada. If you use the standard deduction you cannot deduct any medical expenses. The high cost of hearing aids can mean that millions of Americans avoid buying a hearing device because they cant afford one as they can cost.

Deducting the cost of hearing aids from your taxable income can lower the amount you pay for hearing aids by as much as 35. Subtract that figure from the original cost to determine the. However hearing aids are not entirely tax free in the United States because IRS imposes limits.

According to the Presidents Council for Science Technology1 you should plan to spend around 2300 per hearing aid. 502 Medical and Dental Expenses. Are hearing aids tax deductible 2021.

On her 2021 tax return Amy is allowed a premium tax credit of 3600 and must repay 600 excess advance credit payments which is less than the repayment limitation. If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to deduct. By deducting the cost of hearing aids from their taxable income wearers could reduce the cost of their hearing aids by up to 35.

Divide the original cost by 5 to determine yearly depreciation. Hearing Aids are Tax Deductible Being able to include your hearing aids and their cost against your taxable income at the end of the year isnt maybe the financial assistance you. This means that if you need to wear a hearing aid just for your job for.

A single person with a taxable income of less than 88000 can claim 20. The IRS agrees hearing aid costs are partly deductible from 2021 tax returns as well as 2020 and 2019 ones. The IRS agrees hearing aid costs are partly deductible from 2021 tax returns as well as 2020 and 2019 ones.

However there are saidsome things to consider and. In many cases hearing aids are tax-deductible. Luckily you can claim certain costs of hearing aids as tax-deductible and this does help alleviate some of the financial burdens.

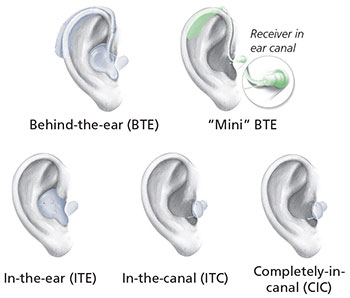

All hearing aid models are tax-deductible. The rules state that if your hearing aids are to be used entirely for your business you can apply for tax relief from them.

Tax Breaks For Hearing Aids Sound Hearing Care

Can Airpods Be Used As Hearing Aids Lsh

Are Hearing Aids Tax Deductible In Canada Ictsd Org

Great News For Tax Season Your Hearing Aids Are Deductible Hearing Associates Of Northern Virginia

How Much Do Hearing Aids Cost Find Answers Here

How To Pay For Hearing Aids Retirement Living 2022

Types Of Hearing Loss Treatment And Hearing Aids In Canada

Are Over The Counter Hearing Aids On The Way Lsh

Are Hearing Aids Tax Deductible Sound Relief Hearing Center

Can I Claim Hearing Aids On My Income Tax Canada Ictsd Org

Best Hearing Aids In 2021 Findcontinuingcare

Are Hearing Aids Tax Deductible In Canada Nexgen Hearing Clinics

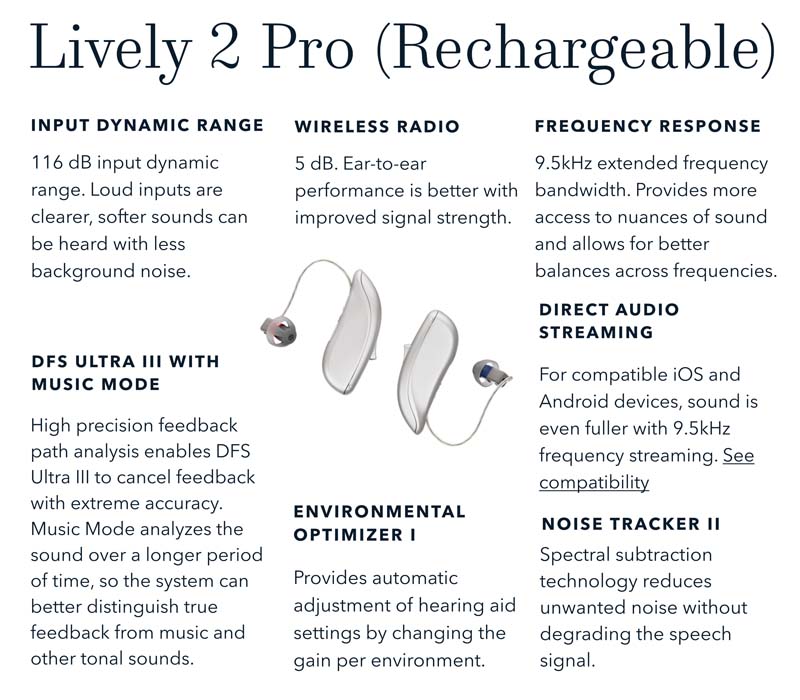

Lively Hearing Aids Reviews With Costs Retirement Living

Costco Hearing Aids 5 Things To Know Before You Buy

Are Hearing Aids Tax Deductible Sound Relief Hearing Center

Are Hearing Aids Tax Deductible Sound Relief Hearing Center

![]()

Are Hearing Aids Tax Deductible Earpros Ca

Are Hearing Aids Tax Deductible In Canada Nexgen Hearing Clinics